-

- News

- Books

Featured Books

- pcb007 Magazine

Latest Issues

Current Issue

The Essential Guide to Surface Finishes

We go back to basics this month with a recount of a little history, and look forward to addressing the many challenges that high density, high frequency, adhesion, SI, and corrosion concerns for harsh environments bring to the fore. We compare and contrast surface finishes by type and application, take a hard look at the many iterations of gold plating, and address palladium as a surface finish.

It's Show Time!

In this month’s issue of PCB007 Magazine we reimagine the possibilities featuring stories all about IPC APEX EXPO 2025—covering what to look forward to, and what you don’t want to miss.

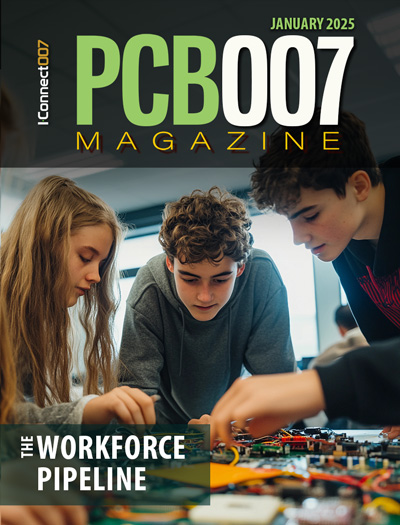

Fueling the Workforce Pipeline

We take a hard look at fueling the workforce pipeline, specifically at the early introduction of manufacturing concepts and business to young people in this issue of PCB007 Magazine.

- Articles

- Columns

Search Console

- Links

- Media kit

||| MENU - pcb007 Magazine

Worldwide Smartphone Shipments Grew 6.4% in 2024, Despite Macro Challenges

January 22, 2025 | IDCEstimated reading time: 2 minutes

According to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker , global smartphone shipments increased 2.4% year-over-year (YoY) to 331.7 million units in the fourth quarter of 2024 (4Q24). This marks the sixth consecutive quarter of shipment growth, closing the whole year with 6.4% growth and 1.24 billion shipments, marking a strong recovery after two challenging years of decline. We expect the market to continue growing in 2025, albeit at a slower pace, as refresh cycles continue growing and pent-up demand is fulfilled.

“The strong growth witnessed in 2024 proves the resilience of the smartphone market as it occurred despite lingering macro challenges, forex concerns in emerging markets, ongoing inflation, and lukewarm demand,” said Nabila Popal, senior research director for Worldwide Client Devices, IDC. “Vendors successfully adjusted their strategies to drive growth by focusing on promotions, launching devices in multiple price segments, interest-free financing plans, and aggressive trade-ins—fueling premiumization and boosting low-end devices—especially in China and emerging markets. While we remain optimistic about continued growth in 2025, the threat of new and increased tariffs from the new US administration has elevated uncertainty across the industry, driving some players to seek preventative measures to mitigate risks; however, thus far, the impact has been minimal.”

While Apple and Samsung maintained the top two positions in Q4 and for the year, both companies witnessed YoY declines, and their shares shrunk thanks to the super aggressive growth of Chinese vendors this year—who drove the overall market by focusing on low-end devices, rapid expansion and development in China. Outside of Apple and Samsung, Xiaomi came in third for the quarter and the year, with the highest YoY growth rate among the Top 5 players. Transsion placed fourth but tied with vivo for the quarter and with OPPO for the year as competition intensified between the three.

“This past quarter was particularly remarkable for the largest Chinese smartphone vendors: Xiaomi, Oppo, Vivo, Honor, Huawei, Lenovo, realme, Transsion, TCL, and ZTE. They achieved a historic milestone as they shipped the highest combined volume ever in a quarter, representing 56% of the global smartphone shipments in Q4,” said Francisco Jeronimo, vice president for EMEA Client Devices, IDC. “While their core markets remain China and Asia, these brands are rapidly expanding their footprint throughout Europe and Africa, driven by the strong performance of their low-end and mid-range devices. Notably, Huawei stands apart, with most of its shipments in the high-end and premium segments, underscoring its distinct market positioning in China.”

"Despite the continued growth across several regions, we have seen a decreased demand for foldables in the market, despite intensified promotions and marketing,” said Anthony Scarsella, research director for Client Devices, IDC. "Vendors have started shifting R&D away from foldables as consumer interest remains flat. Moreover, numerous vendors are prioritizing new AI advancements at the expense of foldables as AI is increasingly featured on more devices, particularly at the market's upper echelon thanks to GenAI.”

Suggested Items

Infinite Electronics Announces Leadership Transition

03/20/2025 | Infinite ElectronicsInfinite Electronics, a leading global provider of electronic components and connectivity solutions, announced today that J. Lindsley Ruth has been named President and CEO. He succeeds Penny Cotner, who has decided to step down as CEO after 12 successful years with the company.

2025: A Year Full of Promises for Delvitech

03/19/2025 | DelvitechAs the calendar flips to 2025, Delvitech, a Swiss innovation leader in industrial inspection solutions, is already off to an exceptional start. With numerous accomplishments and significant milestones achieved early in the year, the company has positioned itself for an even brighter future.

Worldwide Server Market Revenue Increased 91% During the Fourth Quarter of 2024

03/19/2025 | IDCAccording to the International Data Corporation (IDC) Worldwide Quarterly Server Tracker, the server market reached a record $77.3 billion dollars in revenue during the last quarter of the year.

IDC Forecasts PC Shipments in Asia/Pacific to Grow at 4.1% YoY in 2025

03/17/2025 | IDCThe traditional PC market (desktops, notebooks, and workstations) in Asia/Pacific (including Japan and China) dropped by 1.9% in 2024 to 95.5 million units, according to the International Data Corporation (IDC) Worldwide Q uarterly Personal Computing Devices Tracker, Q4 2024. IDC expects shipments to grow in 2025, mainly driven by replacement demand in Japan.

Global Top 10 IC Design Houses See 49% YoY Growth in 2024, NVIDIA Commands Half the Market

03/17/2025 | TrendForceTrendForce reveals that the combined revenue of the world’s top 10 IC design houses reached approximately US$249.8 billion in 2024, marking a 49% YoY increase.