-

- News

- Books

Featured Books

- pcb007 Magazine

Latest Issues

Current Issue

It's Show Time!

In this month’s issue of PCB007 Magazine we reimagine the possibilities featuring stories all about IPC APEX EXPO 2025—covering what to look forward to, and what you don’t want to miss.

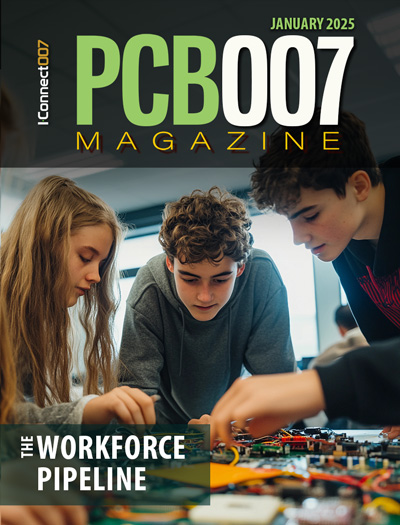

Fueling the Workforce Pipeline

We take a hard look at fueling the workforce pipeline, specifically at the early introduction of manufacturing concepts and business to young people in this issue of PCB007 Magazine.

Inner Layer Precision & Yields

In this issue, we examine the critical nature of building precisions into your inner layers and assessing their pass/fail status as early as possible. Whether it’s using automation to cut down on handling issues, identifying defects earlier, or replacing an old line...

- Articles

- Columns

Search Console

- Links

- Media kit

||| MENU - pcb007 Magazine

Nano Dimension to Review its Options Relative to Stratasys and Other Strategic Acquisition Targets

March 24, 2023 | Nano Dimension Ltd.Estimated reading time: Less than a minute

Nano Dimension Ltd., the largest active shareholder of Stratasys Ltd. with a 14.5% ownership stake, issued the following statement in response to Stratasys’ rejection of its proposal to acquire Stratasys for $18.00 per share in cash. The all-cash offer reflected a 36% premium to the unaffected closing stock price as of March 1, 2023, and a 31% premium to the 60-day VWAP through March 1, 2023.

“We are disappointed in Stratasys’ refusal to engage with Nano Dimension regarding our compelling offer, which would have delivered immediate value at a substantial premium to Stratasys’ shareholders amid a challenging market environment,” said Yoav Stern, Chairman and Chief Executive Officer of Nano Dimension. “After constructive discussions with Stratasys’ CEO, we were surprised that the Stratasys Board was unwilling to engage in an open dialogue around a combination of our businesses. While we remain open to discussions, we are disciplined with regards to our growth strategy and will consider our options, relative to both Stratasys and alternative strategic acquisition targets currently under review.”

Greenhill & Co., LLC and Lazard Frères & Co., LLC are acting as Nano Dimension’s financial advisors, and Sullivan & Worcester LLP is serving as legal advisor.

Suggested Items

Kimball Electronics Reports Q2 Results, Company Updates Outlook for Fiscal Year 2025

02/05/2025 | BUSINESS WIREThe Company ended the second quarter of fiscal 2025 with cash and cash equivalents of $53.9 million and borrowing capacity available of $226.4 million. Capital expenditures were $6.5 million, and the Company invested $3.0 million to repurchase 160,000 shares of common stock.

Benchmark Reports Q4, Fiscal Year 2024 Results

02/03/2025 | Benchmark Electronics Inc.Revenue of $657 million with year-over-year growth in Semi-Cap, A&D and Industrials offset by anticipated weakness in Medical and AC&C.

Plexus Announces Fiscal Q1 Financial Results

01/24/2025 | PlexusPlexus Corp. announced financial results for our fiscal first quarter ended December 28, 2024, and guidance for our fiscal second quarter ending March 29, 2025.

Teledyne Completes Acquisition of Micropac

01/01/2025 | TeledyneTeledyne Technologies Incorporated and Micropac Industries, Inc. jointly announced the successful completion of the previously announced merger of Micropac with a wholly-owned subsidiary of Teledyne.

HANZA Acquires Leden

12/13/2024 | HANZAHANZA AB has signed an agreement to acquire Leden Group, a leading Finnish company in advanced mechanics manufacturing with a turnover of approximately SEK 1,1 billion.